·The first three quarters of the car industry's profit ranking: BYD Guangzhou Automobile surged the FAW system plummeted

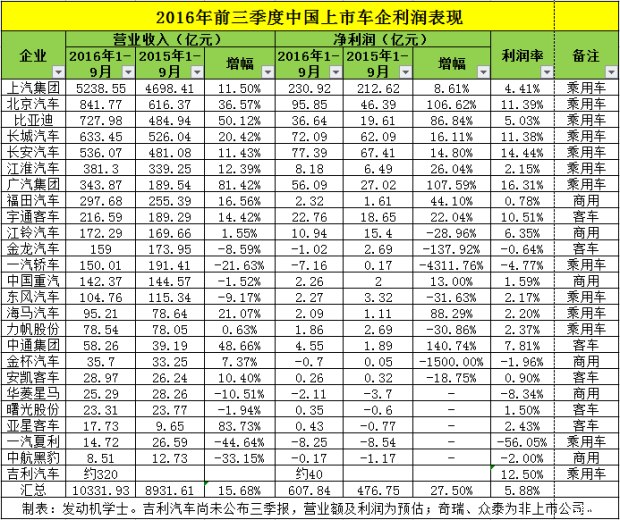

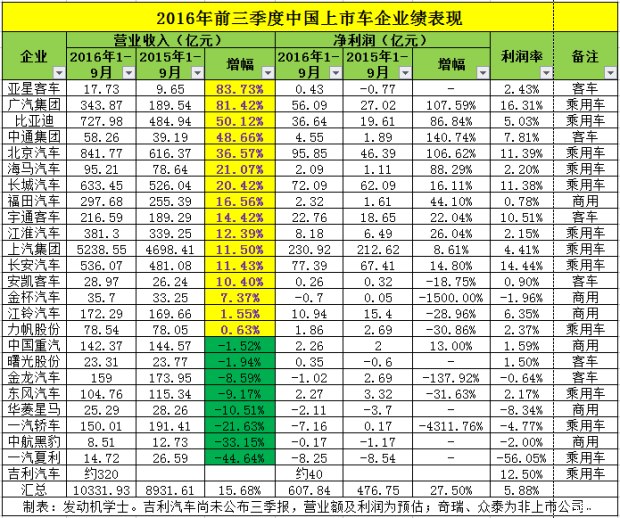

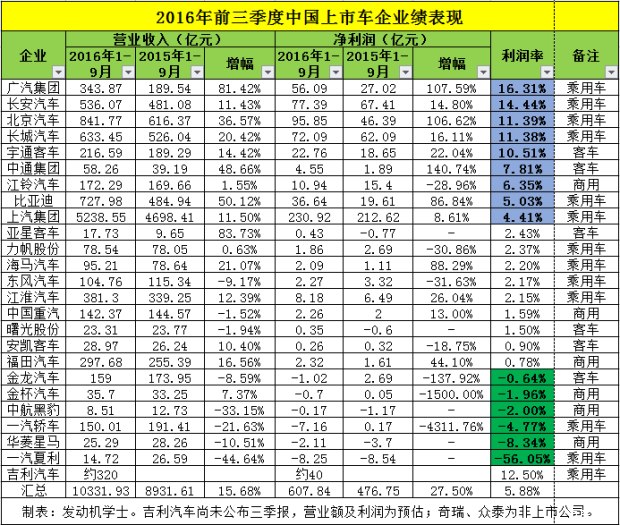

Recently, the three quarterly reports of major listed car companies have been released one after another. More than two-thirds of the total vehicle companies' revenues and net profits have both increased. The author counted the three quarterly reports of 26 listed companies, with only 6 losses; the total revenue of the first three quarters of this year reached 103.393 billion yuan (Geely did not announce the third quarterly report, Chery and Zotye were non-listed companies, revenue was not included), year-on-year growth 15.68%, net profit increased by 27.5%, net profit growth was faster than revenue growth, indicating that car companies' profit margins have increased. The average net profit margin of these companies was 5.88%, up 0.7 percentage points year-on-year. GAC and BYD's revenue surged, the FAW system plummeted On the whole, passenger cars are generally profitable, and passenger car commercial vehicles have lower profits. In addition to the FAW system, car companies based on passenger cars are generally profitable, and most of them achieve positive profit growth. The growth rate of GAC, BYD and BAIC is huge. The profit growth of BAIC and GAC is more than 100%. The profit growth of BYD and Haima Automobile is also nearly doubled. FAW Car (000800, shares it) and FAW Xiali's turnover plummeted, Xiali close to the waist; all huge losses, especially FAW Car burst from a profit of 0.17 billion in the same period last year to a huge loss of 716 million, the performance of diving. The car companies of passenger cars and commercial vehicles are generally poorly profitable, and most of the revenue and profit decline. Yutong and Zhongtong are among the few non-passenger companies with considerable profit growth, and the profit margin is higher. Jiangling's profit is considerable but the year-on-year decline is obvious. Other companies such as Jinlong, Ankai, Shuguang, Yaxing, AVIC Panthers (600760, shares), Futian, Jinbei, Xingma and so on are on the verge of profit and loss. This makes it understandable why many micro-cars, trucks, and bus companies are rushing into the passenger car market, such as Jinbei, Shuguang, Jinlong, and Futian. Trucks and other industries are really too depressed and the profits are too bad. GAC and Great Wall have the highest profit margins. Xiali sells a lost half. Guangzhou Automobile, Changan, and Beiqi have joint ventures, and high profits are inevitable. Of course, GAC passenger cars and Changan’s own brands are very competitive, especially Guangzhou Automobile, which has nearly doubled its sales. BAIC relies mainly on the profit of joint-venture car companies such as Beijing Benz and Beijing, and its own brand is a typical loss-making profit. The most worthy of praise should be the Great Wall and Yutong. There is no joint venture milk and self-reliance. BYD covers its IT and new energy sectors, and its revenue scale is ranked third. However, the auto sector mainly relies on new energy vehicles to make money, and its traditional fuel vehicles are in a state of low profit or loss. China's automaker SAIC Group (600104, shares it), the first three quarters of this year, operating income of 523.855 billion yuan, net profit of 23.092 billion yuan, seemingly profitable, but the net profit margin is only 4.41%. We must know that SAIC has two Boss-class car companies, namely SAIC Volkswagen and SAIC-GM. The profit margin is so low, and it is still not up to the average of 5.88%. It is unscientific. Geely's performance soared, Chery's performance increased Geely has not released the first three quarterly quarterly reports, but according to its semi-annual report sales (280,000), turnover (18 billion), profit (1.93 billion), sales in the first three quarters (459,000), and the new car price range is generally higher than The old model, conservatively calculated that Geely's revenue in the first three quarters should be around 32 billion, the profit should be 35-400 million, a year-on-year increase of more than 100%, the profit rate is over 12%, and the performance is quite excellent. Chery’s sales in January-September increased by more than 30% year-on-year, and the turnover is expected to increase significantly. However, Chery's main selling model, Arrizo 5, is listed at a low price and is sold at a low price. It is expected that Chery's profit margin and profit will remain low.

An anchorage frame secures the Tower Crane mast to a structure or framework and provides stability when the tower crane is under load or experiencing wind forces. The number of Tower Crane Anchorage Frame is calculated by taking into account such factors as the type of tower cranes, jib length, height under hook, and maximum out-of-service wind speed.

Jacking Part Anchorage Frame,Tower Crane Anchorage Frame,Mast Section Anchorage Frame,Anchorage Frame For Tower Crane,Tower Crane Anchor SHEN YANG BAOQUAN BUSINESS CO., LTD , https://www.sczenghui.com

GAC, Changan, Beijing Auto, Great Wall Motor (601633, stock bar), Yutong five car companies profit margins of more than 10%, can be described as earning a full pot; Zhongtong, Jiangling, BYD, SAIC profit margins are also good, the days passed Very moist; Yaxing, Lifan, Haima, Dongfeng, Jianghuai, Zhongqi, Shuguang, Ankai, Futian and other car companies are in a state of meager profit, a bit tight; only six loss-making enterprises, the FAW system accounted for two How does Xiali do it every time Xiali sells more than half a car?